Why You Shouldn’t Judge the Real Estate Market Based on Median Home Price Data

Is the real estate market up or down? What is it going to do in the future?

Questions like this are typically subject to intense speculation and debate. Buyers, sellers, investors, and the media all eagerly await market reports to gain insights into the current trends.

One such crucial report is the National Association of Realtors (NAR) Existing Home Sales (EHS) report, which reports on the median sales price of homes.

A lot of people focus on this data point, but the problem is that this number can actually be misleading, especially when compared to other sources that use repeat sales prices of homes (i.e. Case Shiller Index).

While many reports indicate home prices are rising, the EHS report may suggest otherwise.

Let’s dive into the reasons behind this discrepancy, so you can see why, in today's market, the median home price can be quite misleading.

The Median vs. Repeat Sales Approach

The key to understanding the difference lies in the methodologies employed by various reports. The NAR's EHS report relies on the median sales price, whereas other sources, such as the Case-Shiller and FHFA indices, use the repeat sales approach. These two methodologies can tell different stories and yield distinct results.

The Median Sales Price

The median sale price represents the middle value of homes sold. If more lower-priced homes have been sold recently, the median sale price may decline – even if the value of individual homes is rising. This can create a misleading impression that home prices are falling when, in reality, they may not be.

The Repeat Sales Approach

Repeat-sales methods, on the other hand, calculate changes in home prices based on the sales of the same property. By doing so, they avoid the problem of accounting for price differences in homes with varying characteristics. As a result, these indexes may offer a more accurate representation of home price trends.

The Challenge with the Median Sales Price Today

The current mix of homes being sold significantly impacts the median price data. With fluctuating mortgage rates, buyers often opt for more affordable homes to maintain manageable monthly housing expenses. This increase in the number of lower-priced homes sold can cause the median price to decline. However, this does not necessarily mean that any single home has lost value.

Here’s an example

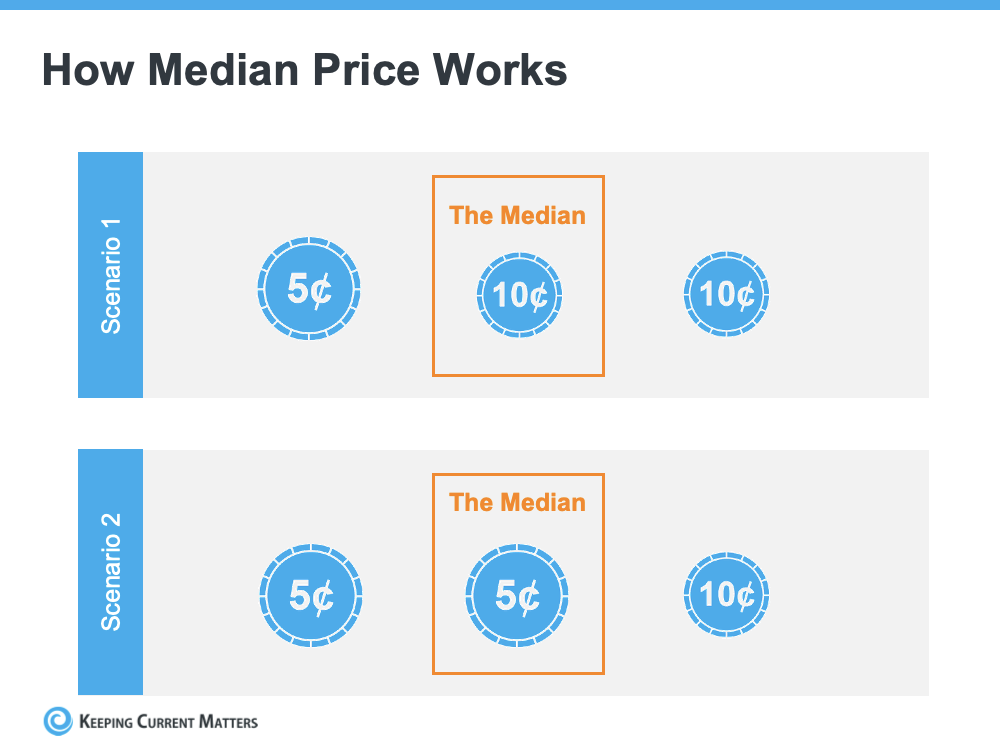

Let's consider a simple analogy of three coins in your pocket, illustrated in the graph below:

If you arrange them by value from low to high, one nickel and two dimes would have a median value of ten cents. But if you have two nickels and one dime, the median value would become five cents. Yet, the individual value of each coin remains the same. Similarly, when the mix of homes sold changes, the median price might fluctuate, but the value of each property remains unchanged.

What You Should Pay Attention To

Homebuyers typically use home prices as a starting point to determine if they fit within their budgets. However, the monthly mortgage payment plays a more significant role in their decisions. When mortgage rates are higher, buyers might have to settle for less expensive homes to maintain affordability. This shift in buying behavior leads to a lower median price, but it does not indicate a decline in home values.

When the latest EHS report is released and it seems to suggest that home prices are falling, it's essential to keep in mind the distinction between median prices and repeat sales indices. Understanding the impact of affordability and mortgage rates on the mix of homes being sold can help us interpret market reports more accurately. So, remember the example with the coins and avoid drawing conclusions solely based on the median price. The real estate market is complex, and it's crucial to delve deeper into the data to make informed decisions about buying, selling, or investing in homes.

We’re always here to shoot you straight and keep you well-informed.

Brent Edwards (aka Brent the Broker) is a residential real estate agent and Realtor in San Diego, CA who helps clients buy and sell homes in San Diego, California and all surrounding areas. Brent is a highly-recommended Realtor in San Diego by family, friends and past clients. Call Brent today at 619-550-8070 if you have any questions about real estate in San Diego or you'd like to buy or sell a home.

Free Downloadables

Let’s Get Your Home Sold

Give your home the best change for a high sale price by avoiding these mistakes.

Let’s Get You a New Home

Get our top 8 proven tips to help you get your offer accepted in a competitive market.